Sustainability // Investor ESG Management

ESG Private Equity Software for Investors

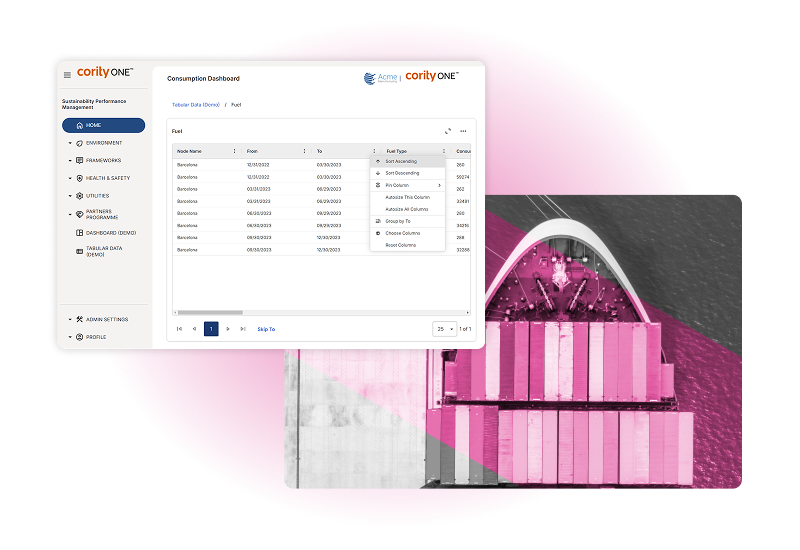

- Portfolio Insights. Streamline ESG data collection, tracking, and analysis across investment portfolios.

- Reliable ESG Data. Align ESG metrics with global frameworks to create investor-grade, audit-ready reports.

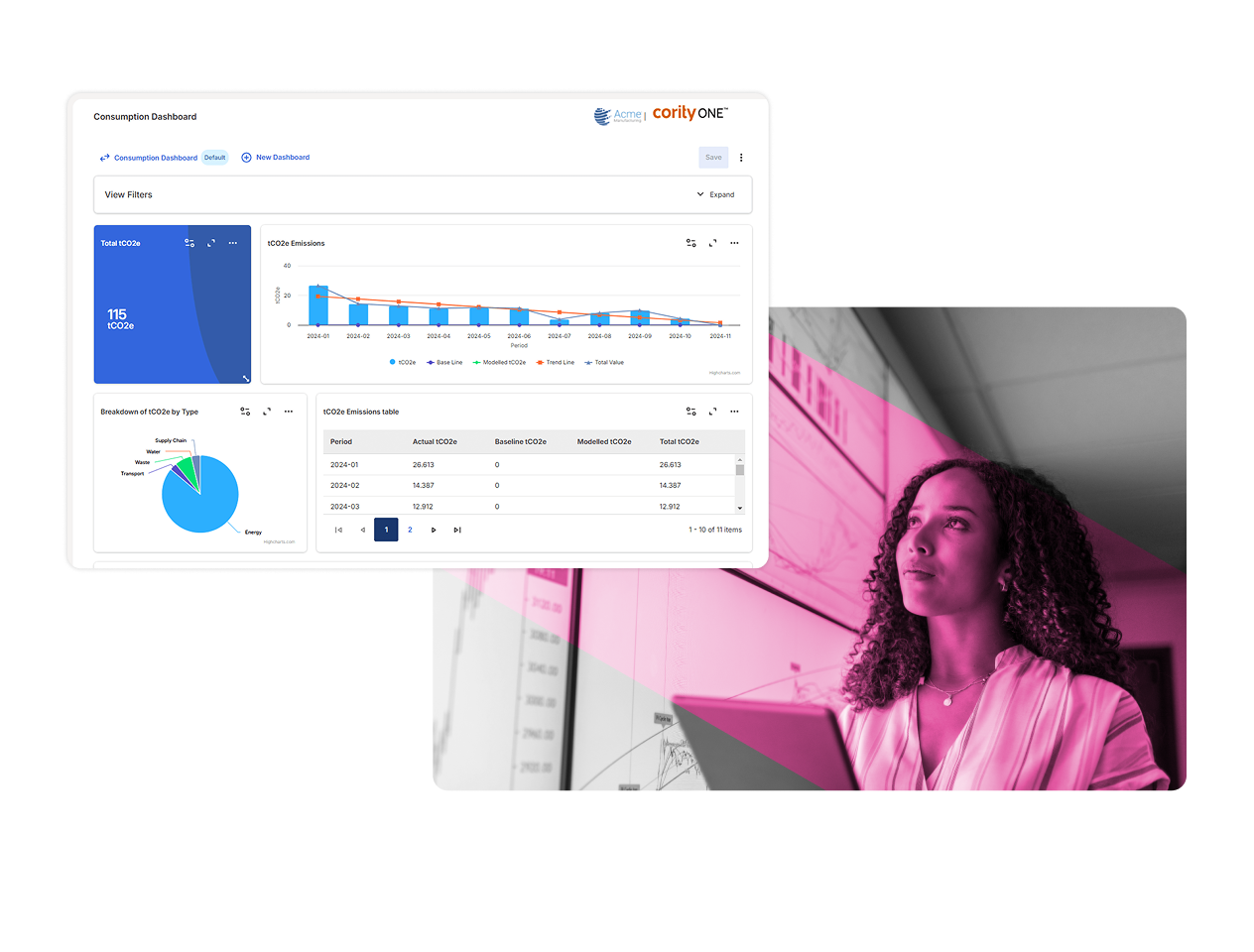

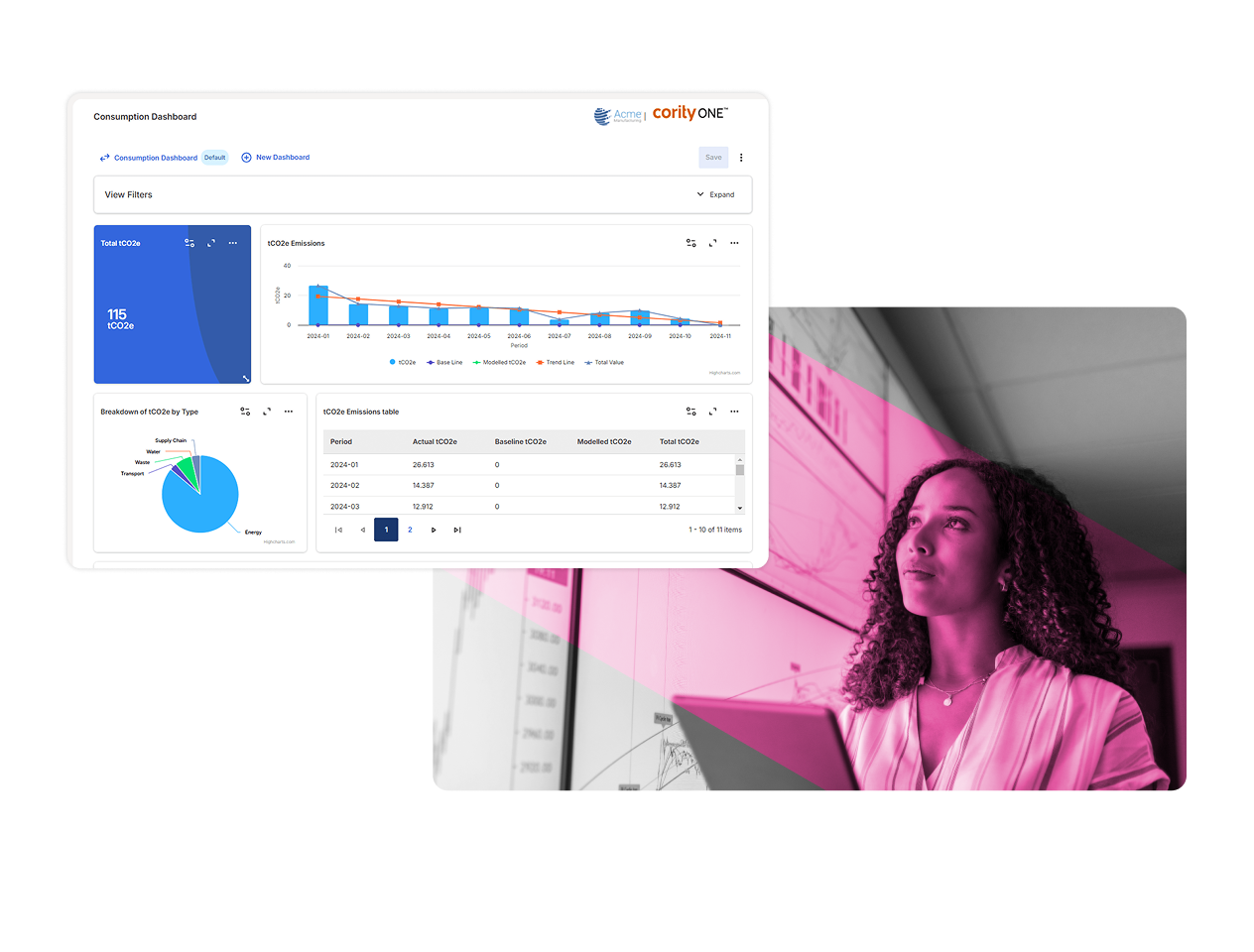

- Stakeholder Trust. Use dashboards and peer benchmarking to enhance ESG credibility and performance.

Supporting organizations advancing ESG performance.

Investor ESG Software Capabilities

Automated ESG Data Collection

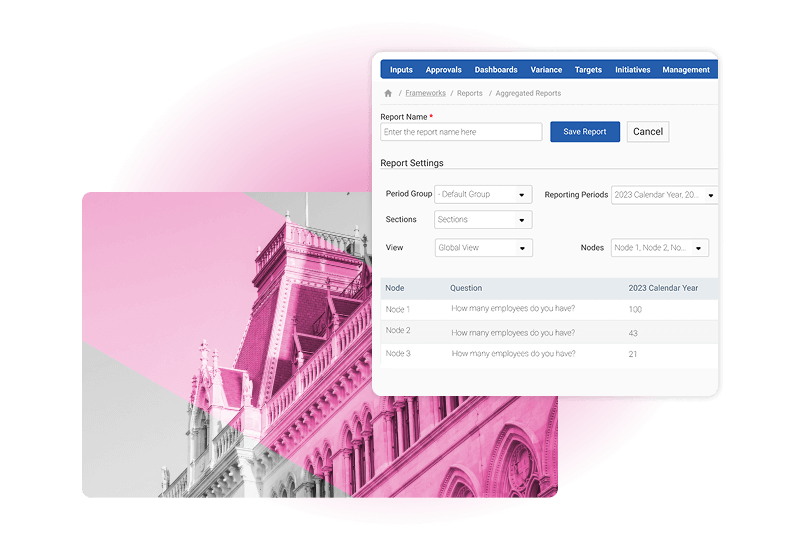

Framework-Aligned Reporting

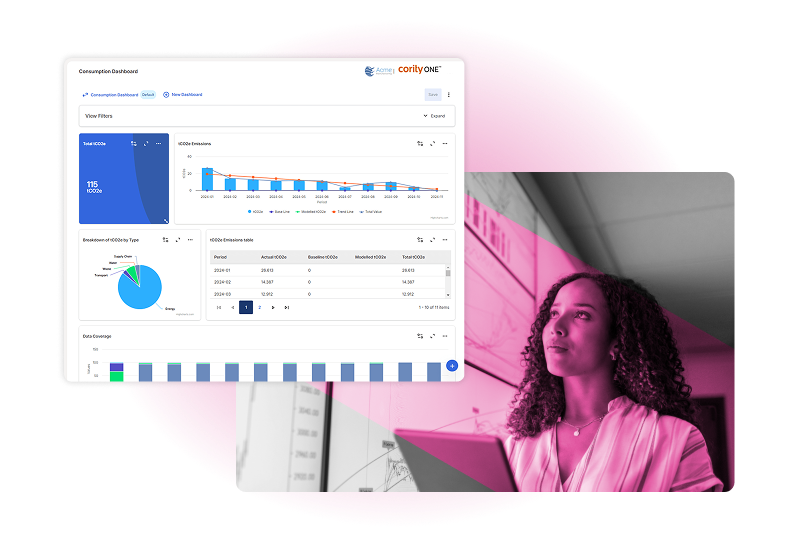

Real-Time ESG Dashboards

Custom Metric Definition

Engagement Tools & Collaboration

Award-Winning ESG & Sustainability Software

Collect ESG Data, Report, Outperform

Step 1: Collect & Centralize ESG Data

Use questionnaires and bulk import to capture ESG metrics across portfolios.

Step 2: Benchmark & Report

Deliver framework-aligned reports and dashboards for investors.

Result: ESG Outperformance

Guide decisions with trusted ESG insights and investor-grade data.

All Sustainability Solutions

Laurent Benard

Managing Partner, CAPZA

“It was crucial for us to select a company with a deep understanding of and a strategic approach to ESG. This platform is well suited to multi-asset class and multi-geographies.”

Resources

Blog

Why Investors are Seeking ESG Software to Manage Portfolio Data

Blog

Across the asset management world, interest in Environmental, Social, and Governance (ESG) performance has soared over the past few years. ESG factors into investment decisions and portfolio management strategies are increasingly becoming the norm and investors are seeking to better understand a company’s long-term value

Blog

Helping Companies Navigate Today’s Evolving Global ESG Regulatory Landscape

Blog

GreenBiz recently published this article on their website. In this article, David Wynn, Director of Product Marketing – Sustainability writes about the increasing ESG regulation with a focus on Europe and the United States. David also shares his expertise on key steps companies can take

Blog

ESG Management Software: The Key to Leveling Up Your ESG Program Initiatives

Blog

Managing and measuring strategic Environmental, Social, and Governance (ESG) initiatives can be a daunting task. ESG, at its core, is a multifaceted approach to understanding and quantifying activities across an entire organization’s value chain including production and procurement, marketing and sales, HR, company infrastructure, and