An interview with Christi Wilson, Trinity Consultants’ most tenured expert on sustainability and environmental compliance.

Welcome back to our Inflation Reduction Act (IRA) blog series. In Part 1, we explored the key provisions in the IRA, most notably the Methane Emissions Reduction Program (MERP), and its potential impacts on the oil and gas industry. The MERP aims to reduce methane emissions from the oil and gas industry by up to 45% by 2030, principally by imposing a Waste Emissions Charge (WEC) on facilities that exceed specific waste emissions thresholds.

In Part 2, we delve deeper into the subject with Christi Wilson, Manager of Sustainability Services & Principal Consultant at Trinity Consultants (Trinity), to learn how organizations can successfully navigate the Act’s regulatory landscape while simultaneously maintaining their commitment to sustainability. Read on as we evaluate methane emissions reduction processes and explore the actionable strategies that will help businesses thrive in this evolving economic climate.

(Note: This conversation has been edited for clarity.)

The Inflation Reduction Act – Part 2:

Cority: From a strategy perspective, can you describe how some organizations have sought to reduce their methane emissions?

Christi Wilson (CW): Many companies start this journey by reviewing the emissions data and reports they have previously submitted to the EPA under the GHGRP. This is a great place to start, since the GHGRP can help organizations account for their most significant emissions sources and provides a prescriptive methodology for calculating emissions from those sources.

Over time, we’ve learned firms will require more granular data to help them make informed decisions on where the best opportunities exist for methane emissions reduction. There are inherent challenges with using the current EPA approach that relies upon industry average emission factors. I think a lot of companies are seeing the benefit of collecting their own site-specific data to help them compare if they are doing better than average, or worse, and where they might have an opportunity to improve. One of the best uses of technology, in my opinion, is the ability to take all data collected and perform deep analysis to glean important insights that can help inform decision-making on where the best opportunities for emissions reduction lay.

As Boards of Directors and investors are applying increasing pressure on companies to reduce their carbon footprints, leveraging real-world empirical data to inform decision-making is becoming absolutely critical. While all our clients are committed to regulatory compliance, many strive to go beyond that and want to know what additional initiatives they should be considering to become industry leaders in climate action. To achieve real progress, management teams want to track performance against climate targets more frequently than annually (typically quarterly, or sometimes even monthly).

Many companies are inundated with thousands of data points from multiple data sources and processes, both manual and digital. These massive data volumes can create a huge administrative burden, especially if you are trying to crunch numbers and run emissions calculations using one or more spreadsheets. This makes it practically impossible to meet these more frequent reporting demands that BODs and management teams are expecting.

We are seeing that many of our clients have outgrown the capabilities of using spreadsheets and can no longer do the work efficiently. Access to more powerful tools to automate data collection and aggregation, easily create emissions calculations, and then run those calculations and analyze the results is critical to identify reduction opportunities and track progress against commitments, while also meeting internal and external reporting requirements in a foolproof and efficient manner.

Cority: What challenges might organizations face when implementing methane emissions reduction strategies under the IRA?

CW: While there are several challenges, the biggest hurdle concerns the way the Inflation Reduction Act lays out the Methane Emissions Reduction Program framework in relation to other regulatory programs.

The IRA directs the U.S. Environmental Protection Agency (EPA) to use the existing Greenhouse Gas Reporting Program (GHGRP) to administer the MERP, albeit with some revisions. Through the MERP, applicable companies will continue to be required to report their methane emissions via the GHGRP, but they could now be subject to a Waste Emissions Charge if those emissions exceed defined thresholds.

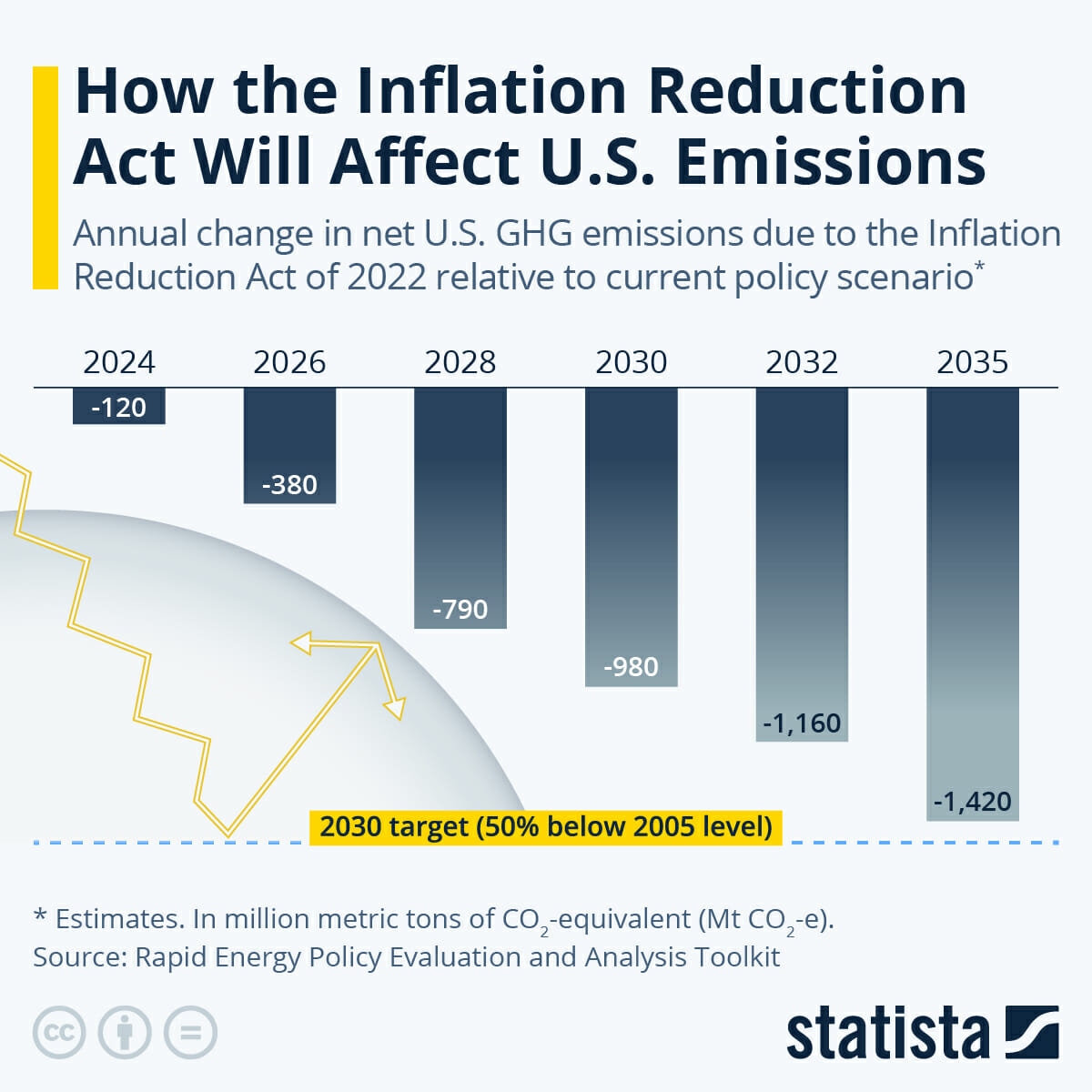

Source: How the Inflation Reduction Act Will Affect U.S. Emissions – Statista

Historically, Subpart W of the GHGRP for the oil and gas sector has relied heavily on industry-average emissions factors. The industry has advocated for some time now for the ability to use site-specific data if/when they have it to calculate emissions more accurately. The language in the IRA actually directs EPA to reevaluate Subpart W with a greater focus on this concept of using empirical (measured) data over average factors. Subsequently, EPA announced a significant number of changes to Subpart W on July 6, 2023, as well as a number of other changes to 40 CFR 98 (in May 2023) that could be impactful to oil and gas reporters.

There are a host of other proposed changes that are likely to increase the calculated emissions for most reporters, including an increase in the GWP for methane from 25 to 28, and the addition of several new source types under Subpart W. The cumulative effect from these various proposed changes may result in more companies triggering reporting under Subpart W as well as applicable companies having greater liabilities under the Waste Emissions Charge. Facilities that report actual methane emissions in excess of 25,000 metric tons of CO2 equivalent per year would be subject to the Waste Emissions Charge.

Additionally, the MERP provides an exemption for sources that are subject to and in compliance with New Source Performance Standards (NSPS) under Subpart OOOOb (which has been

,proposed by the EPA, but not yet finalized).Those standards add control and emission reduction requirements specifically applicable to methane, but the criteria for claiming the exemption under MERP is not clearly outlined in the Act. So, we’ll be anxious to see regulatory language from EPA surrounding this exemption and how it will be applied.

Smart organizations in the Oil & Gas sector should start analyzing their potential exposures and MERP liabilities now and begin their planning to determine what financial liabilities may be going forward.

Cority: Do you have any suggestions for companies to help them overcome the challenges you’ve outlined?

CW: They should not exclusively focus on what they have been reporting under the GHGRP in recent years, but also using the proposed updated calculation methodologies and emissions factors to better understand what they may be reporting in future years.

The ability to efficiently collect more accurate, site-specific operational data is paramount to enabling organizations to conduct these analyses. Technology-based solutions are key to making sure this can be done efficiently and effectively. For larger operators, there are tens of thousands of data points to manage, which means that relying on traditional manual processes and spreadsheets is becoming increasingly impractical.

Cority: What do you suggest companies use to help identify areas for improvement in methane reduction efforts and to track the progress of these efforts over time?

CW: Calculating methane emissions from many sources and facilities in standard oil and gas operations is a significant undertaking. An important first step in tracking progress toward reducing methane emissions is selecting a base year against which you’ll measure future reductions when setting goals/targets. Software can enable this process, by helping to compute a company’s base year emissions and using that baseline for comparison against multiple subsequent years of data.

The oil and gas sector has been reporting under EPA’s GHGRP for more than a decade. Collecting and validating data, performing emissions calculations, and then compiling results for reporting has always been an annual struggle. It’s important to note, however, to date, the program has only been a data collection and reporting effort (e.g., there are no requirements in the legacy GHGRP to actually repair leaks, reduce emissions, etc.; only to calculate and report them). With the implementation of MERP, the financial stakes are now much higher, and organizations will need to manage their compliance risks more proactively than ever.

At Trinity, we advise clients to take a strategic and methodical approach to evaluate their methane mitigation efforts so that they can use their resources most effectively. The adage, “you can’t reduce what you don’t measure” is appropriate here. This brings me back to my earlier comment about making sure the source data is as accurate as possible. Software can help organizations ensure they are more efficient in not only collecting the source data they need but ensuring the quality of that data to support meaningful analysis to better understand their risks and opportunities.

Software can also help organizations evaluate multiple reduction scenarios simultaneously, helping them select the most impactful strategies, while enabling them to calculate their emissions more frequently, and display this information in real-time on dashboards to keep their leaders informed on performance toward reduction goals.

[optin-monster-inline slug=”qujaafmc9phphwvcxjow”]

Cority: It sounds like understanding the implications of the new methane waste emissions charge for each organization starts with looking at your emissions data. Do you find that manual data collection methods are still the standard practice for organizations, or are they turning to other tools to help them manage and analyze their emissions data effectively?

CW: In a handful of cases, we’ve seen larger companies have their own IT folks develop homegrown solutions or databases. More companies are evaluating third-party software solutions with dashboarding capabilities to manage their emissions data and support internal tracking and external reporting. But by and large, most operators in the oil and gas space still currently manage their emissions data using one or more spreadsheets.

That said, if you are trying to establish a base emissions year against which you want to compare all future emissions years, to assess the effectiveness of emissions reduction efforts, it is rather challenging to do that with a traditional spreadsheet approach. It becomes a lot more complex when you want to retain that sort of lockdown – that base year emissions data – and have it for all your future comparisons.

What’s next?

It’s clear the Methane Waste Emissions Charge introduced by the MERP will have significant implications for the U.S. oil and gas industry. The MERP creates multiple challenges for oil and gas producers, including increased compliance obligations, and more punitive financial burdens. Organizations can prepare themselves by creating an up-to-date GHG monitoring plan, investing in robust data management systems, and using air emissions management software.

That’s where Trinity Consultants and Cority can help.

Trinity Consultant’s business model leverages deep industry knowledge to provide high-value services that differentiate them from competitors. They emphasize the importance of high-quality data transparency, strategic emission reduction planning, and setting science-based targets.

Cority gives every employee from the field to the boardroom the power to make a difference, reducing risks and creating a safer, healthier, and more sustainable world. Cority’s Air Emissions Management solution helps firms manage their diverse requirements with consistency, ease, and accuracy – enabling them to reduce errors and consistently respond to potential deviations. We’ve simplified air compliance with a user-friendly interface that increases visibility into potential problems and company-wide trends, centralizes data, and decreases time-consuming manual work for data entry and reporting.

Be on the lookout for the next blog in this series, “The Inflation Reduction Act – Part 3: How to collect and use your data to improve environmental performance.”

[optin-monster-inline slug=”ybial6mvaeej2a2djrwp”]