In this article, we provide an overview of the key things you need to know about the CDP reporting timeline, disclosure options for first-time responders and what’s changed in 2022.

The 2022 CDP Reporting Timeline

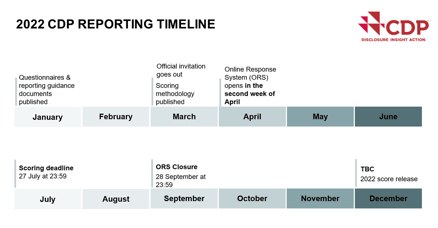

- In January the questionnaires and reporting guidance documents were published on CDP’s website, giving companies access to the updated questionnaires.

- The scoring methodology is also now available on the CDP website (as of 14 March) and an ‘An introduction to 2022 scoring‘ document is available.

- The official invitation to disclose that comes from CDP on behalf of their investor signatories to each company’s board of directors will be sent out in March.

- Companies who have disclosed to CDP in the past will be receiving this request via email and those who have never disclosed to CDP before will be receiving an email as well as a physical letter titled ‘Letter to the Board’ sent to the company’s headquarters or postal address.

- The Online Response System (ORS) will open in the second week of April and this will officially start the 2022 disclosure cycle, as it’s the time when all companies will be able to fill out their responses.

- The next milestone in the reporting timeline will be the scoring deadline. This will be on the 27th of July this year. To be eligible for a score, companies have to submit a full version of their response by then.

- However, they can also submit an unscored version of their response until the 28th of September, which is when the ORS will close, and this will signal the end of the 2022 disclosure cycle.

- The scores will be released in late 2022. The date hasn’t been finalised, but scores can be expected around Christmas time.

Disclosure Options for first-time CDP Responders

If this is your first year responding to a CDP questionnaire, there are a couple of different disclosure options available to you:

- You can respond to the full version of the questionnaire by the scoring deadline (27th July 2022) and opt for a private score. This score will only be made available to you and to CDP and will be kept private from requesting investors. This is the route CDP would always recommend companies take in their first year so companies get a sense of what it is like to respond but also to check their performance before officially submitting to investors or purchasing companies.

- You can respond to the minimum version of the questionnaire. The minimum version contains fewer questions than the full version does not have any sector-specific questions, and won’t be scored. You have until the 28th of September to submit this response.

- You can submit either version of the questionnaire by the 28th of September. This response won’t be scored, but your data will still be shared with CDP’s investor signatories and any other requests.

- Alternatively, first-time responders can submit the full questionnaire by the scoring deadline and receive a public score.

The 2022 Climate Change Questionnaire

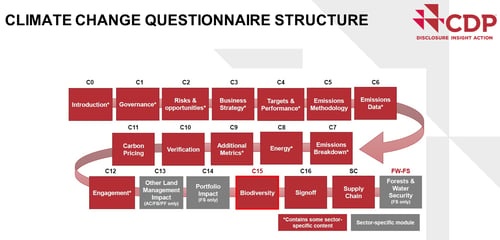

The climate change questionnaire has seen the most changes in 2022 compared to the forests and water questionnaires, and it is worth mentioning that about 70% of the 2021 questions remain.

The climate change questionnaire primarily asks companies to lay out their energy and emissions data. CDP asks companies to look at any climate-related risks and opportunities that they have identified and answer questions. Other modules will also look at the organisation’s governance as well as business strategy.

In 2022, the total number of questions has gone up to 130. Since companies can take different paths, no one company will respond to all 130 questions.

Key Changes to the 2022 Climate Change Questionnaire

Focus on Net Zero

There have been improvements made to the governance and strategy modules to increase the focus on how companies are planning to transition to net-zero by 2050. There have also been improvements made to the emissions inventory and energy and engagement modules for RE100 members there will be six new questions available and these questions will allow them to report to the RE100 initiative through the CDP questionnaire.

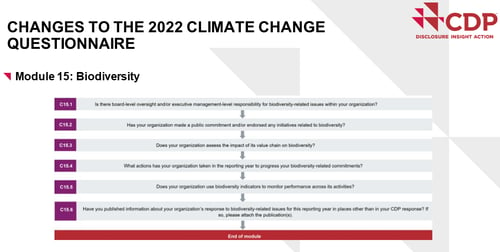

Biodiversity Module

In line with CDP’s 2025 strategy, CDP has introduced a new biodiversity module, and it marks the first step in broadening the range of environmental issues covered by its questionnaires. This module will apply to everyone disclosing to the climate change questionnaire, bringing the total number of modules in the questionnaire to 15. As carbon emissions are only one part of the challenge, these climate-nature crises need to be addressed simultaneously by conserving, protecting and restoring the ecosystem.

As demand is increasing for biodiversity-related data, this information will enable financial institutions to develop investment strategies and engage effectively with companies to address the risks of biodiversity loss throughout their value chains.

The new module has two key aims. The first is to gather data on the extent to which companies have an impact on biodiversity and if they have a strategy in place. The second aim is to signpost the key areas that companies should be reporting on. Each question in the new module relates to a key concept of reporting related to biodiversity such as board-level oversight, impact assessment indicators, and performance monitoring. By disclosing this data, organisations will be able to evaluate the relevance and efficacy of their commitments but also consider the biodiversity-related risks and impacts of their business practices.

Financial Services’ Water and Forests Module

The financial services climate change questionnaire has undergone a lot of changes in 2022. Those in the financial services sector will see a new module on forests and water focussed on financial institutions’ impact on nature and their exposure to nature-related risks from the activities they finance. This will sit at the end of the climate change questionnaire, bringing the total number of modules to 16.

The questionnaire will ask companies to look at their portfolio impact as opposed to their operational impact. They will be requested to report information related to forests and water security if they invest in sectors that have a high to critical impact on the environment or a high dependency on nature. So, not all financial services companies will be seeing this module.

It is important to note that the climate change score will not be impacted by the forest and water module. Companies will be able to get a private score for forests and they won’t be scored on water security in 2022.

CDP’s Alignment with External Frameworks

CDP is driving a greater coherence amongst other frameworks and standards and in doing so they have aligned their questionnaires with as many frameworks as possible, including most notably the Task Force on Climate-Related Financial Disclosures (TCFD), the Global Reporting Initiative (GRI), the Sustainable Development Goals (SDGs), and others. This aims to reduce the reporting burden on companies and enhance the benefits of disclosing. As regulation and reporting requirements evolve, CDP will continue to align with the necessary frameworks to ensure that the questionnaires are always relevant.

CDP’s disclosure platform provides the mechanism for reporting fully in line with the TCFD recommendations, by translating the TCFD recommendations and pillars into actual disclosure questions and a standardised annual format. CDP provides investors and disclosures with a unique platform where the TCFD framework can be brought into real-world practice. Companies that disclose through CDP are doing so in line with the TCFD recommendations, in a comparable and consistent way that is relevant and accessible to the global economy.

Cority’s Sustainability Performance Management Software

Cority’s Sustainability Performance Management software has been designed to meet the requirements of CDP reporting and has a suite of dedicated tools to streamline the process. This includes GHG Protocol-aligned data collection covering Scope 1, 2 & 3, climate change risks and opportunities, and an initiatives savings functionality for analysing savings against targets.

Using Cority’s Sustainability Performance Management software companies can:

- Define bespoke question sets from a range of reporting frameworks, including CDP, SASB, GRI and SDGs

- Collect data and supporting information across a diverse organisation

- Consolidate data into internal and external reporting templates

As well as software, Cority provides its clients with support services to help them improve their reporting, and performance and achieve their broader sustainability goals. With in-depth knowledge of the CDP reporting system, our team of industry experts works closely with our clients through the whole process to ensure they submit a robust, clear and complete CDP response.