In the jargon-heavy world of sustainability reporting, the last thing we need is another buzzword. Our focus should be on helping organizations understand their environmental impacts and act more sustainably. Natural Capital can sound like a sustainability buzzword but it is a term that we can trace back to the 1980s. It has an important role to play in helping organizations understand the broader natural environmental cost and impact of their business.

Putting a value on Natural Capital is a logical progression from the traditional focus on reporting operational sustainability performance. Organizations reporting their sustainability performance typically reflect on the previous 12 months. Following by looking a few years ahead by setting targets and goals. In reality, for companies to secure long-term success, they need to look further ahead. For some companies, this means taking 10, 15, or 20 year dependencies into consideration. As well as how they may change over time.

The objective of Natural Capital valuation is for an organization to place a value on their environmental interdependencies over the short, medium and long term horizons. Advocates of Natural Capital valuation highlight the invisibility of environmental or natural impacts in traditional financial systems. There is a need to redesign this model to include the monetization of natural environmental impacts in accounting systems and when assessing the long term sustainability of a business.

How can a business put a price on future damage from climate change? Or the cost of pollution on a supplier community? This isn’t straightforward but organizations need to start looking to place a value on these dependencies. This will help them take a step towards responding to their impacts. It will also help them in reporting the true associated risks and costs of the business.

What do we mean by Natural Capital?

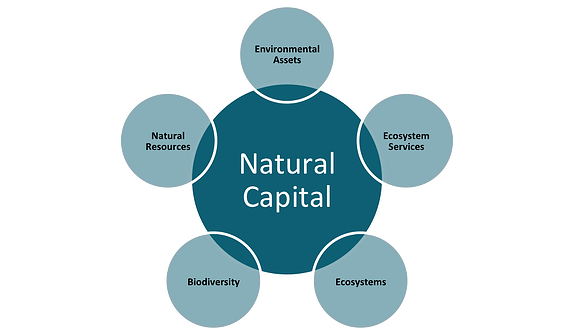

There are a number of definitions of Natural Capital. Some distinguish between ecosystems, ecosystem services, biodiversity and natural resources. However, broadly a consensus forms around it being an aspect of the natural environment that provides value to people. In the Natural Capital Protocol, the Capitals Coalition defines Natural Capital as ‘the stock of renewable and nonrenewable natural resources (e.g., plants, animals, air, water, soils, minerals) that combine to yield a flow of benefits to people’ (adapted from Atkinson and Pearce 1995; Jansson et al. 1994).

The Capitals Coalition comprises of 380 global initiatives and businesses. Their aim is to ensure that by 2030, the majority of the world’s businesses, financial institutions, and governments incorporate natural capital into their decision-making processes. It also worth noting that Natural Capital encompasses a number of terms and potential impacts.

What is value?

Broadly, we use value to quantify the importance, worth and usefulness of something. By stating that something has value for your organization, you closely associate it with its materiality to the organization. Monetary value underpins financial reporting. However, the transition of a similar value approach to wider environmental impacts is in its infancy for most reporting organizations. In order to understand wider Natural Capital value it is important to look beyond the simple financial cost of using a product or resource and consider its broader upstream and downstream impacts.

Is Natural Capital valuation just “Materiality +”?

The plethora of sustainability reporting frameworks offers us a range of definitions for materiality. The scope, timeframe and stakeholder groups involved in a materiality assessment are the three critical components that vary between definitions. Nevertheless, fundamentally materiality is just that, reporting what matters to an organization. Valuing Natural Capital as part of a materiality assessment may require considering new stakeholder groups who are associated with the natural environmental impacts on which the organization depends.

Valuation Vs Accounting

Sustainability reporting that creates value should communicate performance on issues that stakeholders care about. These issues could cover a wide range of topics and are well documented in sustainability reporting frameworks such as GRI. At the heart of Natural Capital valuation is ensuring that business dependencies and impacts on the natural world are taken into consideration as part of the reporting process. The scale of valuing Natural Capital as part of a sustainability reporting process could range. It can include thinking about the suppliers selected or a structured accounting approach that seeks to quantify non-financial impacts with the same rigor as financial impacts. Using either approach, these assessments should feed into a high-level strategy of engraining sustainability in the operations, products and geographies of the business.

Techniques for Monetizing Natural Capital

The Natural Capital Coalition outlines various techniques for calculating the monetary value of environmental impacts, dependent on the availability of information and the relationship of the impact with a business. A robust monetary valuation is possible when market prices are obtainable from existing market structures and can be used to determine the economic value of an environmental benefit.

Where the impact sits outside of existing markets, three methods of producing a non-market valuation are possible. The first is cost based calculations which estimate the cost of avoided damage or ecosystem replacement. Avoided damage costs could occur from protecting a coastal region for example. As a result, people and property are prevented from being lost and degraded which has an associated economic value. Similarly, in the instance of replacement costs, an economic value can be attributed to replacing specific ecosystem services if they are lost. For example, natural biodiversity may need to be replaced by man-made sea-walls to maintain coastal protection which in turn incurs an economic cost.

The other two non-market valuation techniques require information on stakeholder preferences. Whether they be realized in actual costs or in stated preferences to hypothetical scenarios. In realized costs a stakeholder might state how much they have spent on coastal preservation. Whereas in stated preferences, a stakeholder might hypothetically state how much they would be willing to pay towards the protection of a coastline or endangered habitat.

The final technique relies on secondary data to apply value estimates to similar scenarios. This can be useful when other market techniques are not available to apply comparable costs to areas of similar land types, such as the value of a hectare of wetlands.

Inevitably Natural Capital accounting will involve a combination of these techniques based on the availability of data and the type of environmental dependency that is being monetized.

Methods for Valuing Natural Capital: Descriptions and Example Outputs

| Method | Description | Example Output |

| Market Valuation

|

Market-based direct valuations based on market prices

|

E.g. Net Present Value of harvested timber (£/ha) |

| Non-Market Valuation

|

Cost Based – Avoided damage or replacement costs | E.g. Value of avoided water treatment costs (£)

|

| Revealed or Stated Preference – Travel cost or hypothetical survey

|

E.g. Recreation travel costs or willingness to pay (£)

|

|

| Secondary Data Valuation

|

Applying existing value estimates to similar cases

|

E.g. A value transfer of wetland value per hectare (£/ha)

|

How Cority Can Help

Cority’s Sustainability Performance Management solution provides a powerful platform for tracking and reporting environmental impacts. You can effectively incorporate Natural Capital principles into their sustainability strategies. Start by leveraging Cority’s advanced features, such as automated GHG emissions calculation and real-time performance monitoring. Our comprehensive solution supports accurate data collection, robust analysis, and precise reporting. We aim to ensure that businesses not only meet their sustainability targets but also gain deeper insights into their long-term environmental dependencies and risks. Ready to start? Talk to one of our experts today!